Why Do Employees Want Work From Home

In this post COVID world, a large amount of the country’s workforce is working remotely. More job seekers are searching for jobs where they have the opportunity to work from home. Working remotely can save employees time and money. Work from home can promote a more productive work environment. One of the top benefits for applicants is a flexible schedule and remote work promotes that concept! Even those currently employed and working in the office are seeking to work remotely at least part of the time.

What Does It Mean For Businesses

Working remotely, however, can mean your employee can live in or move to a different state than the state that your business does business in. Payroll and HR laws require a business to follow the laws in the state in which the employee works. As a business owner there are steps you need to take to stay compliant when you have employees that work out of state.

What Should Businesses Do To Stay Compliant

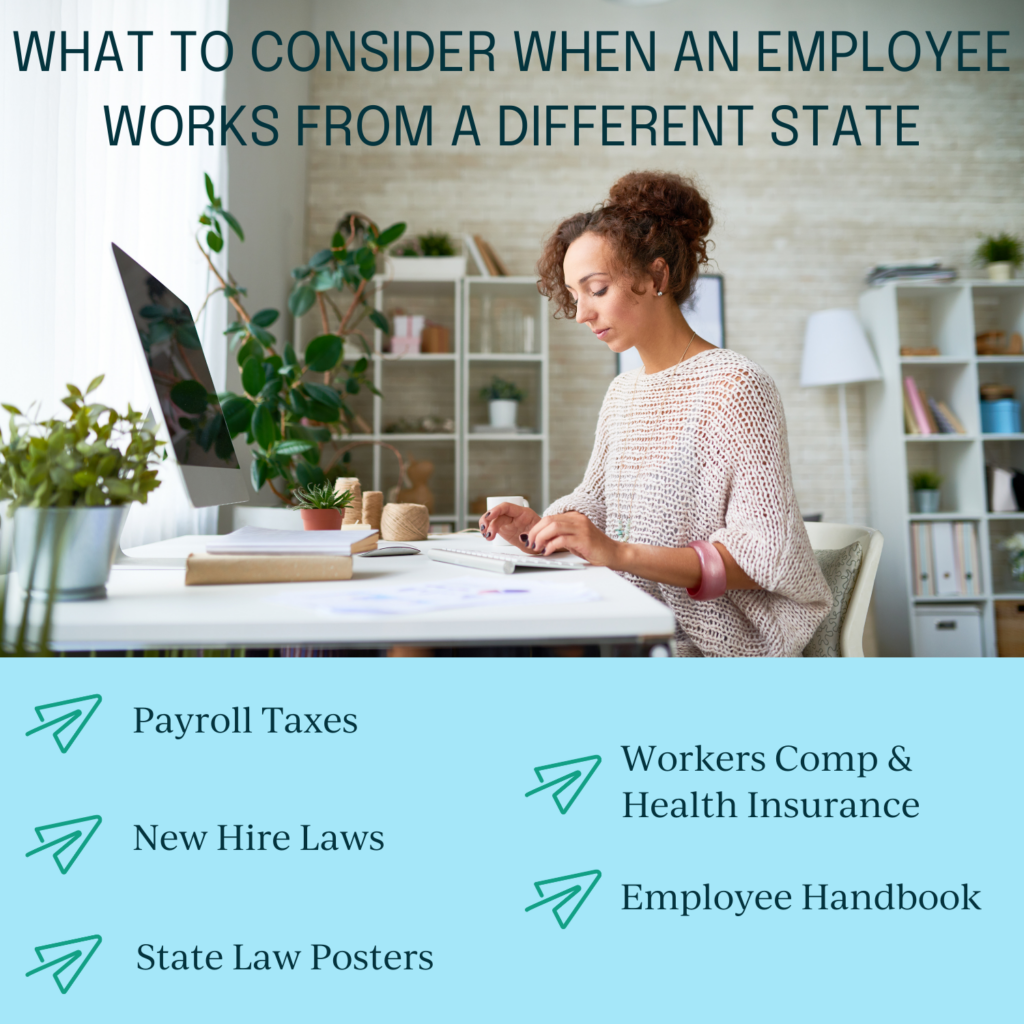

In order to stay compliant, businesses should consider the following things when they have an employee living in a different state than the state that they conduct business:

- Most importantly, you’ll need to set up payroll tax accounts in the new state in which the employee physically works. This is the state in which you will need to use for things such as:

- state income tax withholding

- unemployment tax contributions

- minimum wage laws

- state workers compensation insurance

- any other specific state or local tax laws

- Review the new state’s new hire paperwork requirements and update the forms your business uses if necessary. Report new hires to the state within the state’s specific requirements.

- Provide the employee with any required employment law posters for the new state the employee is living and working in.

- Notify your workers’ compensation carrier and, if you offer it, your health insurance carrier that you have an employee working in a different state.

- Update your employee handbook with any new state laws that apply and provide the updated handbook to the employee.

How Business Can Get Help

Trying to stay up to date on the differences in laws between different states can be difficult for business owners or HR directors. When an employees moves out of state, it maybe a good time for your company to outsource the payroll and HR processes. Getting setup with a payroll vendor will help your company stay compliant. Payroll companies, such as Paper Trails, will setup out of state workers correctly for your company, allowing you to not have to worry about learning the tax and HR laws of other states. Contact us to get help today!