Paper Trails > Payroll Year End

Payroll Year End

Year end for business owners and HR professionals can be a stressful time. Luckily, we have you covered with the resources you need to get you through year end without a hitch.

There is so much to consider when it comes to payroll year end.

From a payroll and human resources perspective, year end is one of the most important parts of successfully operating a business. Our team has put together everything you need to ensure a smooth year end. We have compiled monthly tasks, important information, and handy resources to make year-end payroll processing easier.

Our Payroll Year-End Checklist is Coming Soon

A few highlights from our payroll year-end checklist

2025 Labor Law Changes

Salary Threshold

Federal DOL has increased the minimum salary threshold for exempt (salaried) employees. Effective July 1, 2024, the minimum salary threshold increased to $844/week ($43,888 annually). Starting January 1, 2025, the minimum salary threshold will increase to $1,128/week ($58,656 annually).

These are weekly requirements, not annual salary amounts and do not include bonuses, commissions, etc. There are very few exceptions to this new ruling. Be sure your salaried/exempt employees are meeting the new wage thresholds and begin budgeting for potential impacts in 2025. If your salaried employees do not meet these new wage thresholds, you MUST pay them overtime.

Maine Paid Family and Medical Leave

Maine's Paid Family and Medical Leave Program begins January 1st, 2025. Be sure to enroll your business in this program and begin withholding payroll tax deductions as required by law.

November Tasks

Verify all your company information is correct

Be sure to have the correct data to when filing your taxes. This includes:

- Federal & State tax ID numbers

- Legal name & business address

- State Unemployment Tax rates

Prepare yourself for Affordable Care Act annual reporting

If you and your associated businesses are considered applicable large employers and have more than 50 full-Time equivalent employees, you will need to prepare and submit 1094-C and 1095-C forms to your employees.

Begin gathering year end W-2 adjustments

W-2 adjustments are often non-cash contributions, but include the following items:

- S-Corporation shareholders’ health insurance premiums and mileage reimbursements

- Group term life paid on behalf of employees over $50,000

- Third party sick pay

- Personal use of a company vehicle

- Non-cash payments like gift cards or other “fringe benefits”

Prepare for Veterans Day & Thanksgiving payroll processing

Veterans Day is observed Friday, November 11th. Banks will be closed so submit your payroll early!

Thanks giving is Thursday, November 28th. Banks will be closed so submit your payroll early!

December Tasks

Process all manual & voided checks

Have you paid employees by manual checks outside of payroll? You must record those manual checks on payroll to ensure that all wages are legal. Further, third party sick pay, personal use of an employer-provided vehicle, qualified moving expenses, club memberships and more must be reported on W2s!

Review 3rd party sick pay

Third party sick pay is an insurance benefit often called short or long-term disability insurance. If an employee has used this benefit during the year, you will likely need to report taxes and wages through payroll. While these payments are not made through the employer, the taxes must be reported by the employer. Your disability insurance provider will send you quarterly statements.

Report fringe benefits

A fringe benefit is any form of payment for performance of services. Generally, these are things like gift cards, employee gifts, personal use of a company car, gym memberships, etc. These are considered taxable wages and must be reported on an employee’s W-2.

Process your final payroll of the year

Please carefully review your final payroll of the year. There are several items to review:

- Employee names, addresses and social security numbers should be reviewed and accurate.

- Final benefit deductions, PTO pay outs, fringe benefits, etc are accurate.

Prepare for 53 Wednesdays

In the 2025 calendar year, there are 53 Wednesdays. If you have a Wednesday pay day, and you pay your exempt (salaried) employees based on an annual salary, you may want to consider adjusting their weekly or bi-weekly payroll amount to accommodate for a potential additional check. This may or may not apply to you, but we don’t want you to be caught flat-footed at the end of 2025 and potentially overpay an exempt employee when you didn’t want to. Skipping a payroll for most employees is not very palatable.

January Tasks

Submit 1099s for preparation

You must provide 1099s to any independent contractors who have worked for you in 2024 no later than January 31st! Use this spreadsheet and email it over to vicki@papertrails.com

Review and update 2025 retirement contributions

Many employees or owners like to maximize pre-tax retirement benefits. Update employee deduction amounts to ensure the maximum contributions are made for the year. You can find 2024 limits here.

Download, print & display current labor law posters

You must display both federal and state labor law posters prominently in your business for all employees to review. These are published for free by the federal and state governments. You should download, print and display the most accurate labor law posters which are available here.

Send W-2 and 1099 forms to your employees

It is your responsibility to distribute/mail W-2s & 1099s to your employees before January 31st!

Implement Maine's Paid Family Leave Program

Tips for Payroll Year End

Double Check Social Security Information!

Remember New State and Federal Legislation Changes for the Upcoming Year

Depending on what state you do business in, there may be some new compliance challenges to consider. For Maine businesses, start preparing for the State’s retirement mandate that begins in 2024. You can also check out our webinar about this program on our YouTube channel.

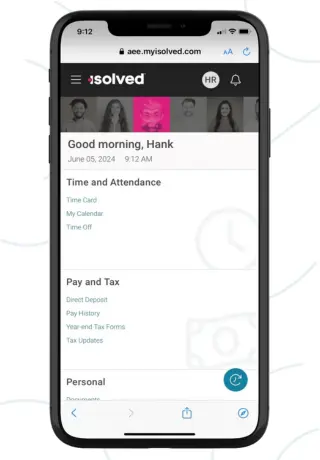

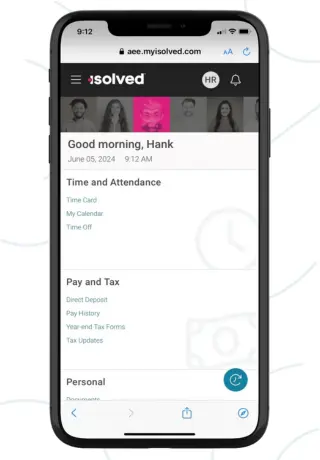

Download the New isolved Mobile App

isolved has released the new isolved People Cloud mobile app for employees. This is in addition to our current self-service portal at myhrstuff.com.

Employees can access their pay stubs, change their direct deposit information, clock in and out, request time off (if enabled) and even retrieve their W2s all online without ever having to bother you! All you need to get started is each employee’s email address. Full instructions on how to enable access to the app for your employees is available at papertrails.com/self-service. If employees are having trouble logging in from the isolved app, helpful tips & tricks for password resets and more are located at papertrails.com/help.

Contact your payroll processor if you have further questions or need help activating this feature. Download the app from the app store today!

Stay Up-to-Date On Key Compliance & HR Tips

Our team at Paper Trails posts regularly on social media. These posts are most often important compliance news, HR & payroll tips and industry information that will impact your business! Be sure to follow across all of our platforms to stay up to date! Sometimes, we even post a funny video or two 😉!

Can’t find what you’re looking for? Contact our local team.